Established in 2006, Business Finance Depot has been a leader in providing specialized financing solutions tailored to the outdoor hospitality industry. Under the experienced leadership of Paul Bosley, the company has evolved into a key financial resource, expertly navigating complex loan processes for RV parks, campgrounds, and glamping resorts across the United States.

What sets Business Finance Depot apart is their comprehensive suite of financing options, including SBA 7(a) loans, SBA 504 loans, USDA loans, commercial loans, equipment financing, ROBS programs, equity financing, and bridge loans. Their vast network—featuring partnerships with 30 national SBA and USDA lenders and 20 equipment financing companies—enables them to offer uniquely flexible solutions customized to each client’s specific project needs.

At Sage Outdoor Advisory, we’ve teamed up with Business Finance Depot to help clients who need feasibility studies for SBA and USDA loan approvals. Together, we combine their financial expertise with our detailed feasibility analysis, giving clients the support they need to secure financing and confidently launch their outdoor hospitality projects.

Q&A with Paul Bosley, Founder & Managing Member at Business Finance Depot

Background

Tell us a bit about your company’s history:

I founded Business Finance Depot in 2006 with the goal of providing accessible business financing. Our introduction to the RV park and campground industry began nearly a decade ago through financing projects with Camp Jellystone, which expanded significantly after I began teaching finance courses at the ARVC (now OHI) National School and exhibiting at events like the Glamping USA Show. Today, we’ve facilitated over $224M in loans and leases and currently have $165M in approvals with 163 active clients.

What inspired you to work in outdoor hospitality?

My passion stems from earning a degree in Recreation and Parks and a lifelong goal of working within park systems. My personal investment, owning an Airstream Pottery Barn travel trailer and spending extensive time RVing, deepens my connection to the industry. My bucket list includes visiting every national park, which I find truly awe-inspiring and beautiful.

Services and Expertise

What services do you offer, and what sets your approach apart?

We uniquely provide a broad range of financing options tailored specifically to outdoor hospitality. Our services include SBA and USDA loans, commercial loans, equipment financing, ROBS programs, equity financing, and bridge loans. Unlike typical financing firms, our versatility ensures clients aren’t constrained by limited products or lender-specific limitations.

How do you address current trends in the industry?

We’re proactive in adapting to industry growth, particularly with the booming RV park and glamping sectors. By regularly exhibiting at national and regional trade shows, contributing to industry publications like Woodall’s Campground Magazine, and sending targeted monthly newsletters, we stay at the forefront of emerging trends and best practices.

Projects and Achievements

What’s a standout project your team has worked on?

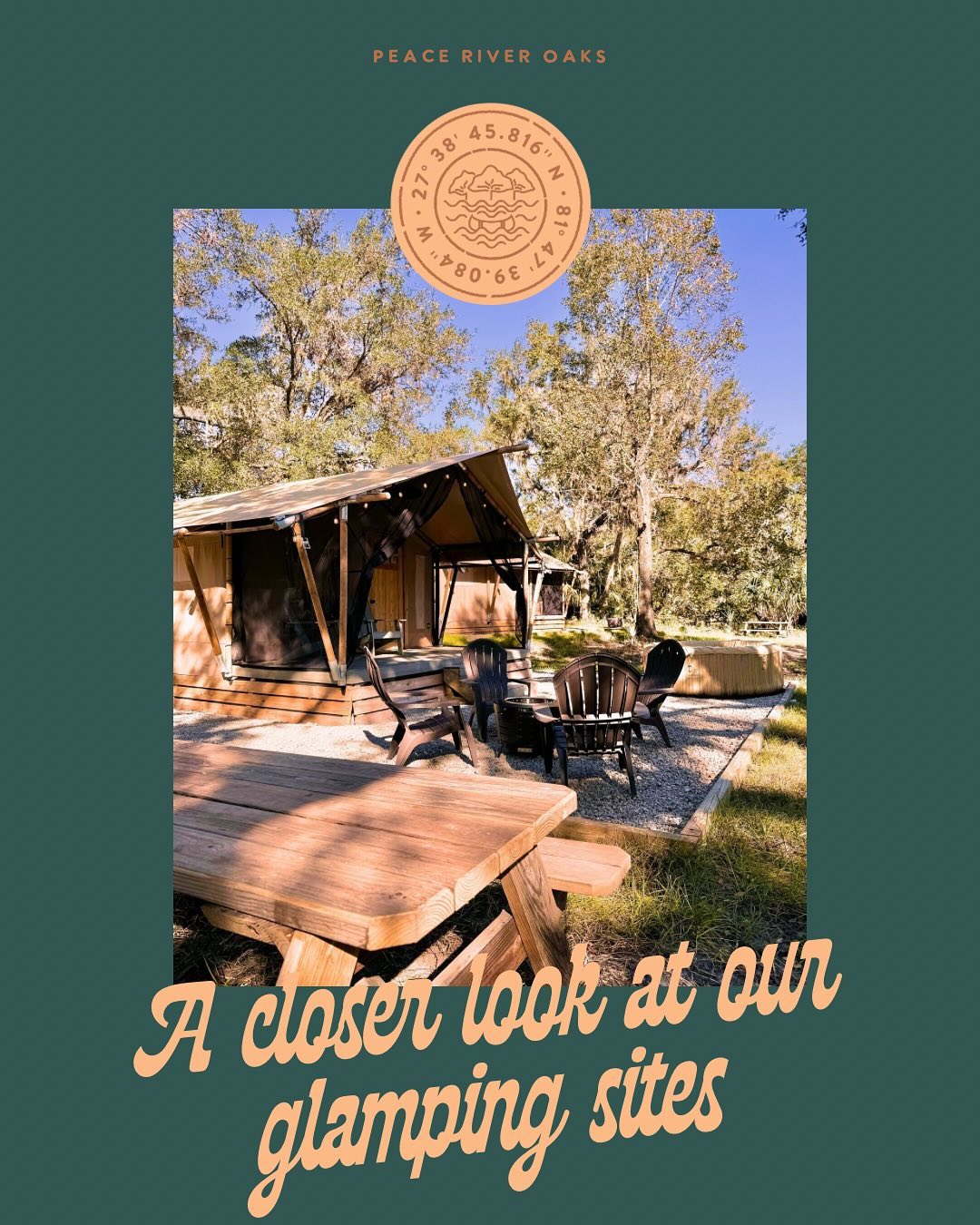

Recently, we successfully funded Peace River Oaks in Florida using an SBA loan, and we’re finalizing financing for a Camp Jellystone location in Groesbeck, Texas, utilizing a USDA loan. Both projects exemplify our commitment to helping clients achieve their goals through tailored financial strategies.

What outcomes do your clients achieve with your help?

Clients rely on us to identify the most effective financing paths. We meticulously package and present loan requests to appropriate lenders, ensuring successful openings with adequate working capital. This structured approach consistently yields successful business launches and sustainable growth.

Partnership With Sage

How has your partnership with Sage Outdoor Advisory impacted your work?

Our partnership is highly beneficial. We refer our clients needing feasibility studies to Sage Outdoor Advisory, essential for securing SBA and USDA loans. This collaboration streamlines the financing process, ensuring clients receive timely and professional support.

What do you enjoy most about collaborating with us?

Working with Sage Outdoor Advisory, particularly under Shari Heilala’s professional and responsive leadership, is rewarding. Sage’s active role and strong presence in the RV park and glamping industries consistently enhance the quality and efficiency of our collaborative projects.

Looking Ahead

What exciting projects are on the horizon?

Currently, we have 25 clients with over $200M in financing underway, including 14 projects totaling over $159M in USDA loans, six projects totaling over $35M in SBA 504 loans, and five projects totaling over $7M in SBA 7(a) loans. We’re also expanding our financing capabilities to support larger projects through strategic partnerships, including new equity gap financing solutions starting at $1M.

How do you see your role in shaping the future of outdoor hospitality?

Our ongoing focus is to provide robust financing solutions capable of supporting larger, innovative outdoor hospitality projects. By continuously expanding our services and lender relationships, we’re committed to driving industry growth and supporting entrepreneurs in creating sustainable, inspiring outdoor experiences.